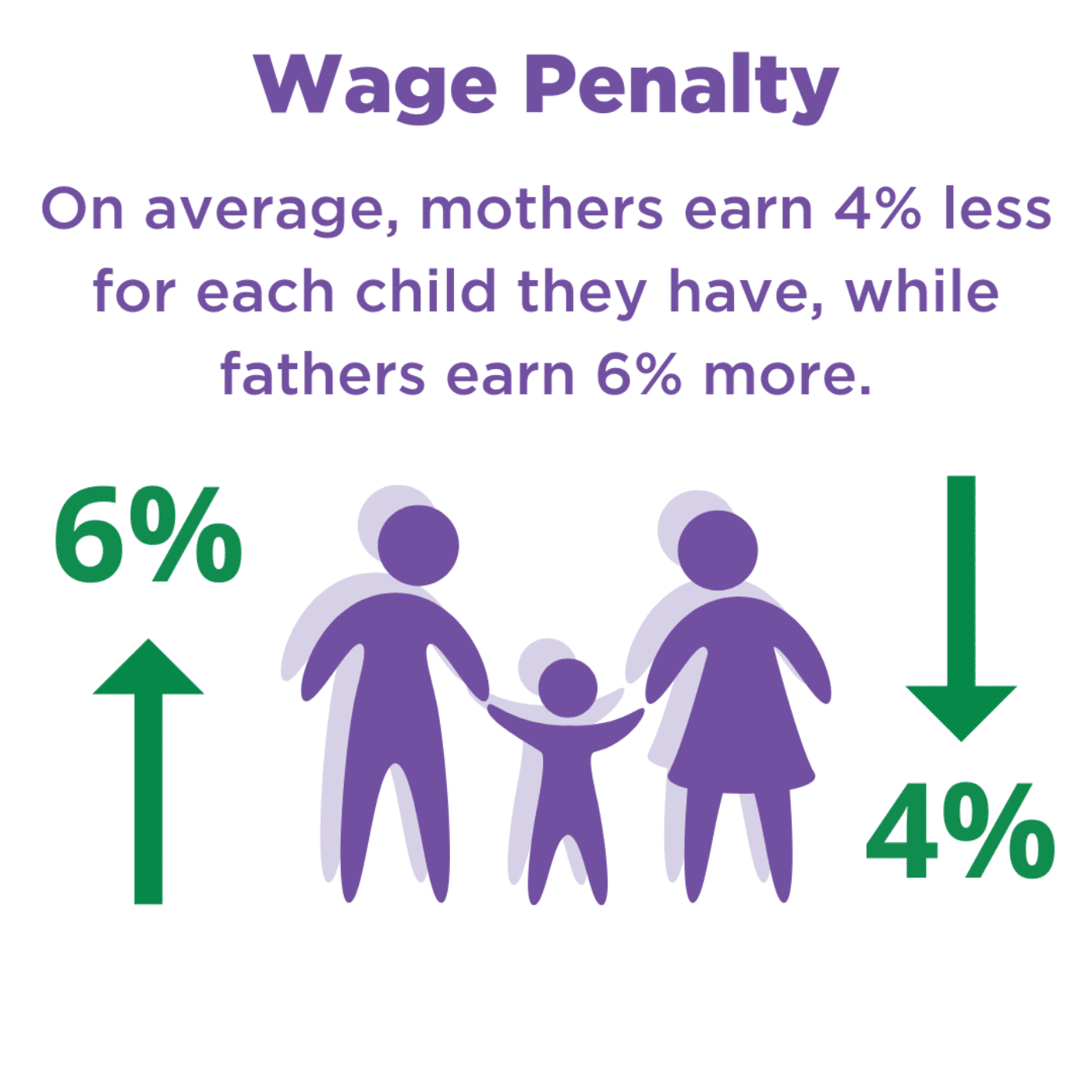

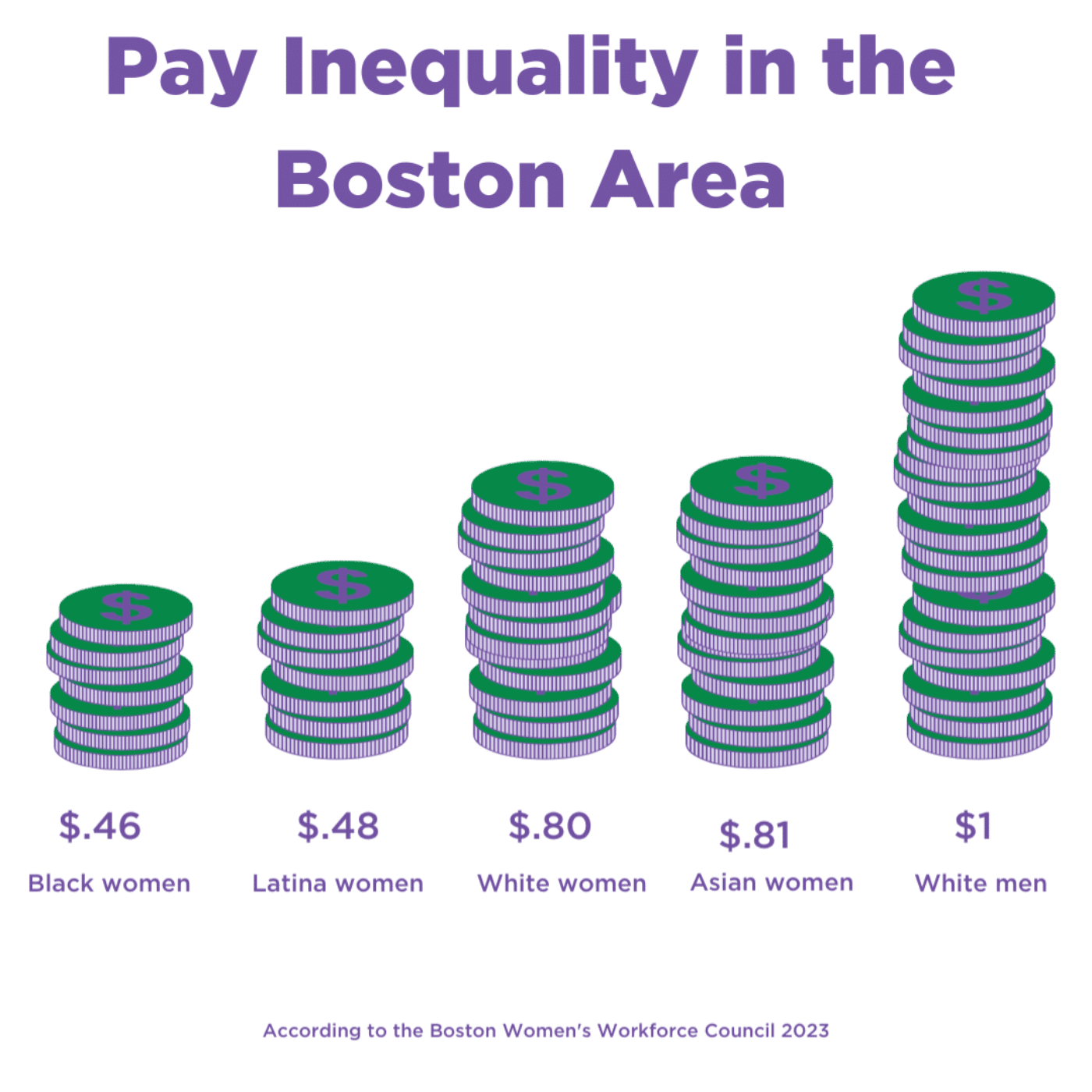

Financial Inequalities

COVID's Impact on Women

Covid caused a “she-session” with many women losing income as female workforce participation has dropped to 57%, the lowest since 1988. Over 5.4 million women left or lost jobs since the pandemic started, and women living on the economic margins continue to suffer the greatest economic losses.

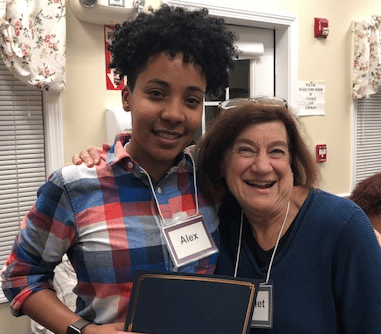

Women’s Money Matters is working to meet this increased demand, expanding our virtual financial group-based money-management workshops and one-to-one individualized coaching to provide more women with the financial resiliency, peer connection and emotional support needed during this time of deep financial need and uncertainty.

Why Women?

1 in 7 women in the US live in poverty

The financial literacy gap between men and women in the US is about 59% wider than the rest of the world

33% single mother households in Massachusetts live in poverty

Our Role

While social-service agencies increasingly recognize that low-income households have a greater chance of breaking the cycle of poverty when they know how to manage their money effectively, few agencies have the resources to provide financial education to those who need it. Women’s Money Matters was created to fill this gap.