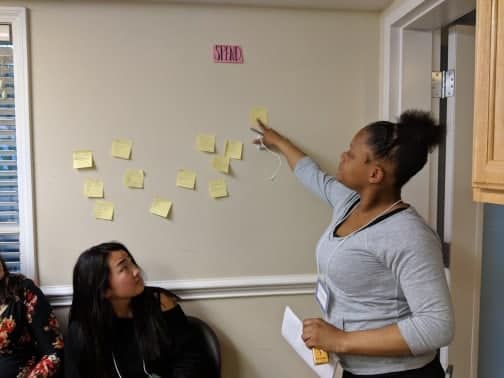

Volunteers are core to our work at Women’s Money Matters. Our participants know that our coaches and presenters are not showing up to support them because they are being paid to do so – they are doing it because they genuinely care.

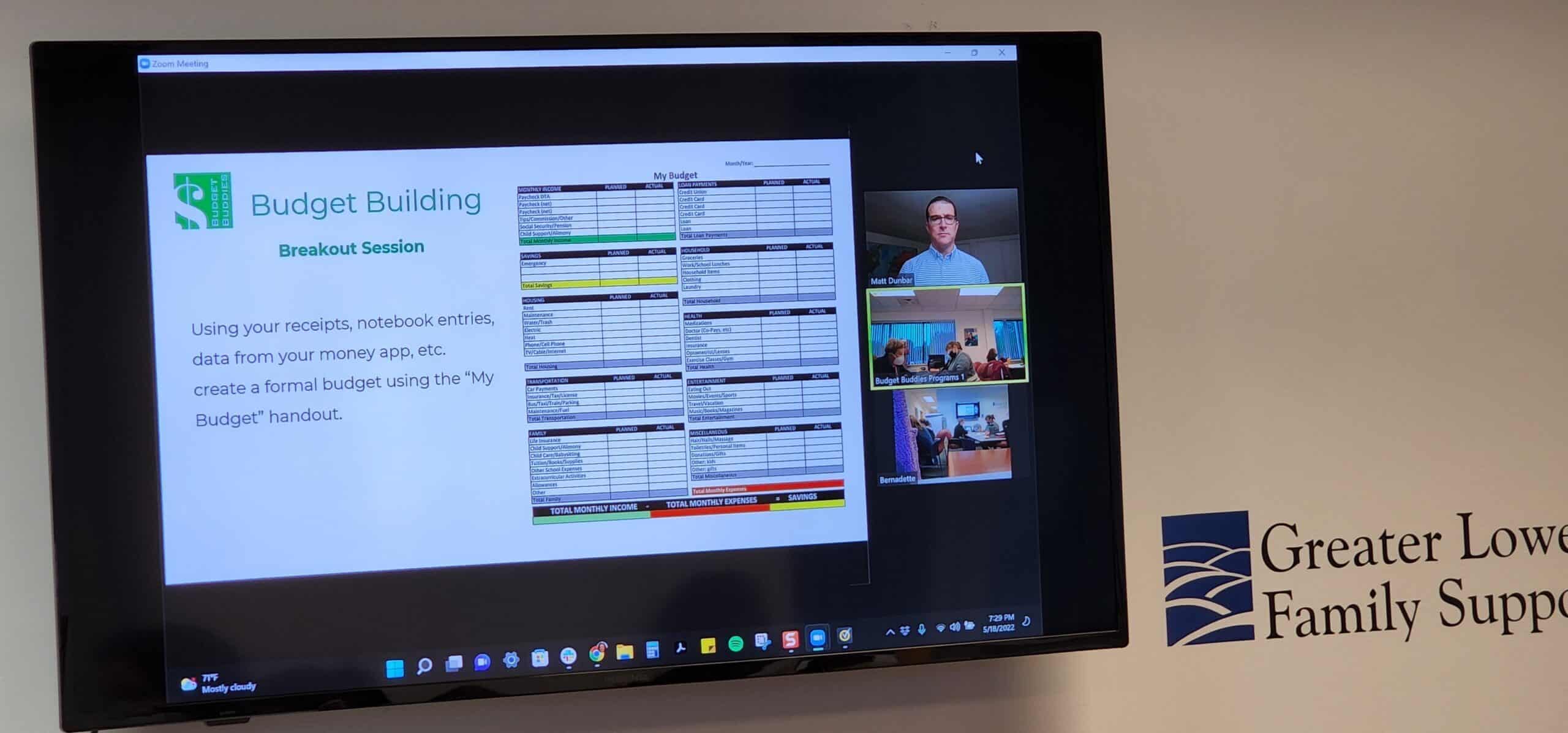

Our fully-remote programs offer a range of volunteer opportunities and ways to help out from anywhere you are. We also have some limited in-person volunteering opportunities!

All you need is the desire to help another woman in your community make the most of the money she has.

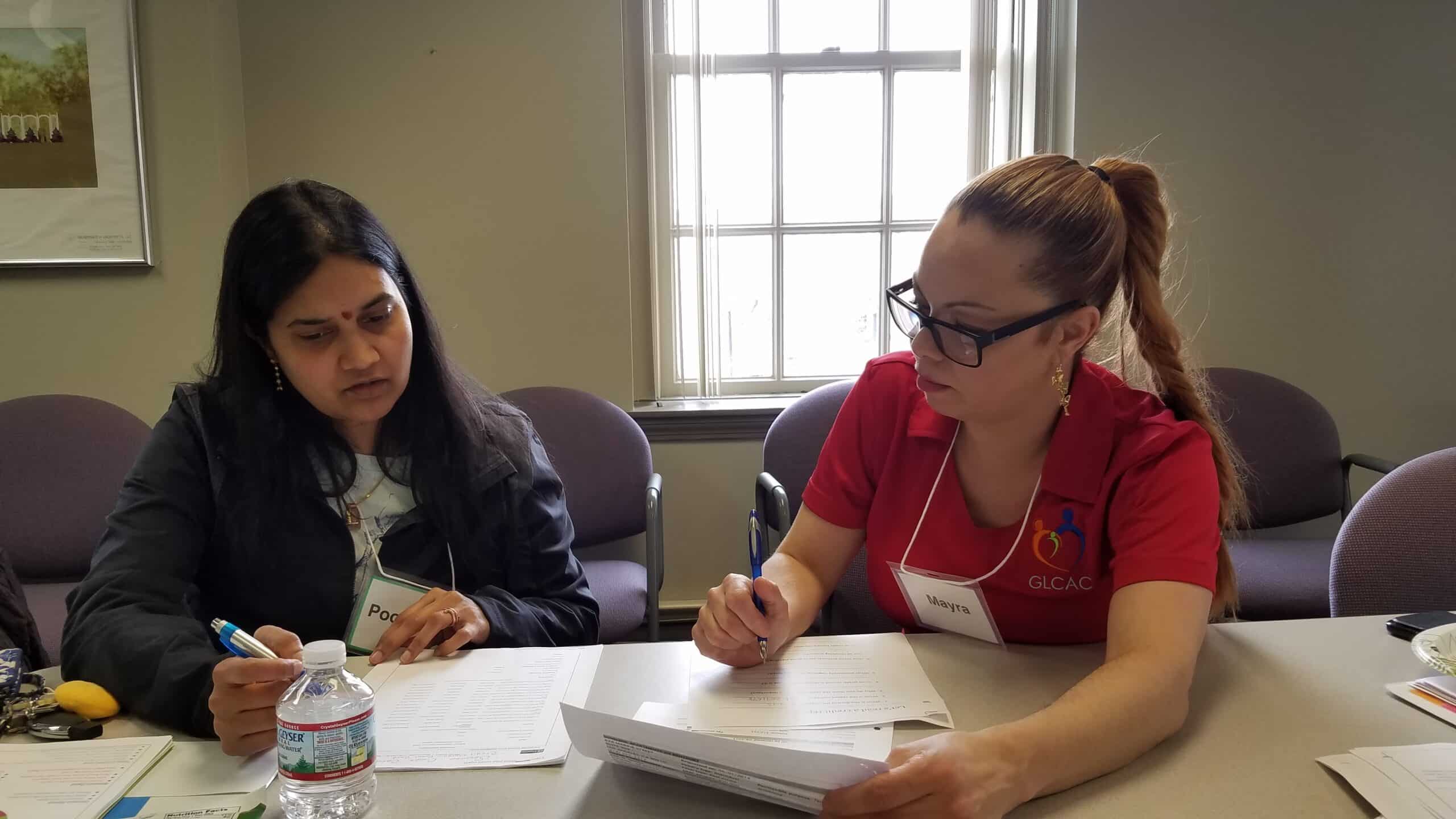

We believe diversity in identity and perspective enriches our programs and helps us better serve our clients. We strongly encourage people of color, LGBTQ-identifying individuals, people with disabilities, and other underrepresented groups to apply to become a coach.