You do not have to be a financial expert to help.

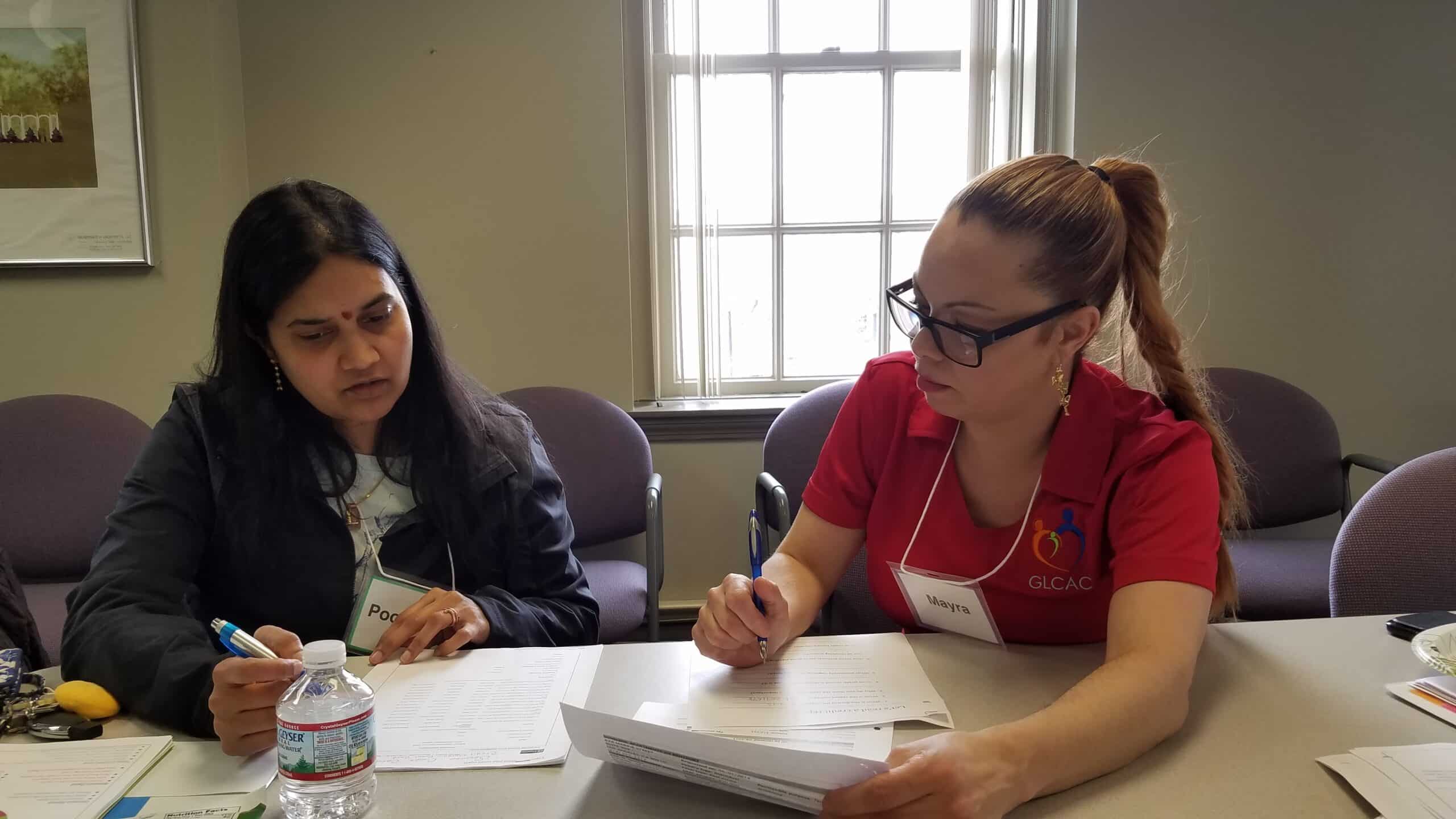

Volunteers are core to our work at Women’s Money Matters. Our participants know that our coaches and presenters are not showing up to support them because they are being paid to do so – they are doing it because they genuinely care.

Our fully-remote programs offer a range of volunteer opportunities and ways to help out from anywhere you are. We also have some limited in-person volunteering opportunities!

All you need is the desire to help another woman in your community make the most of the money she has.

We believe diversity in identity and perspective enriches our programs and helps us better serve our clients. We strongly encourage people of color, LGBTQ-identifying individuals, people with disabilities, and other underrepresented groups to apply to become a coach.

Get Started Volunteering with WMM

Ways to Get Involved

Step One: Apply to join us as a volunteer coach or presenter by submitting your application and selecting an introductory orientation to attend.

Coach

Coaches are the backbone of our one-on-one coaching model. Coaches are thoughtfully paired with a program participant for the duration of the program. They work directly with their partner to help them reach their specific financial goals.

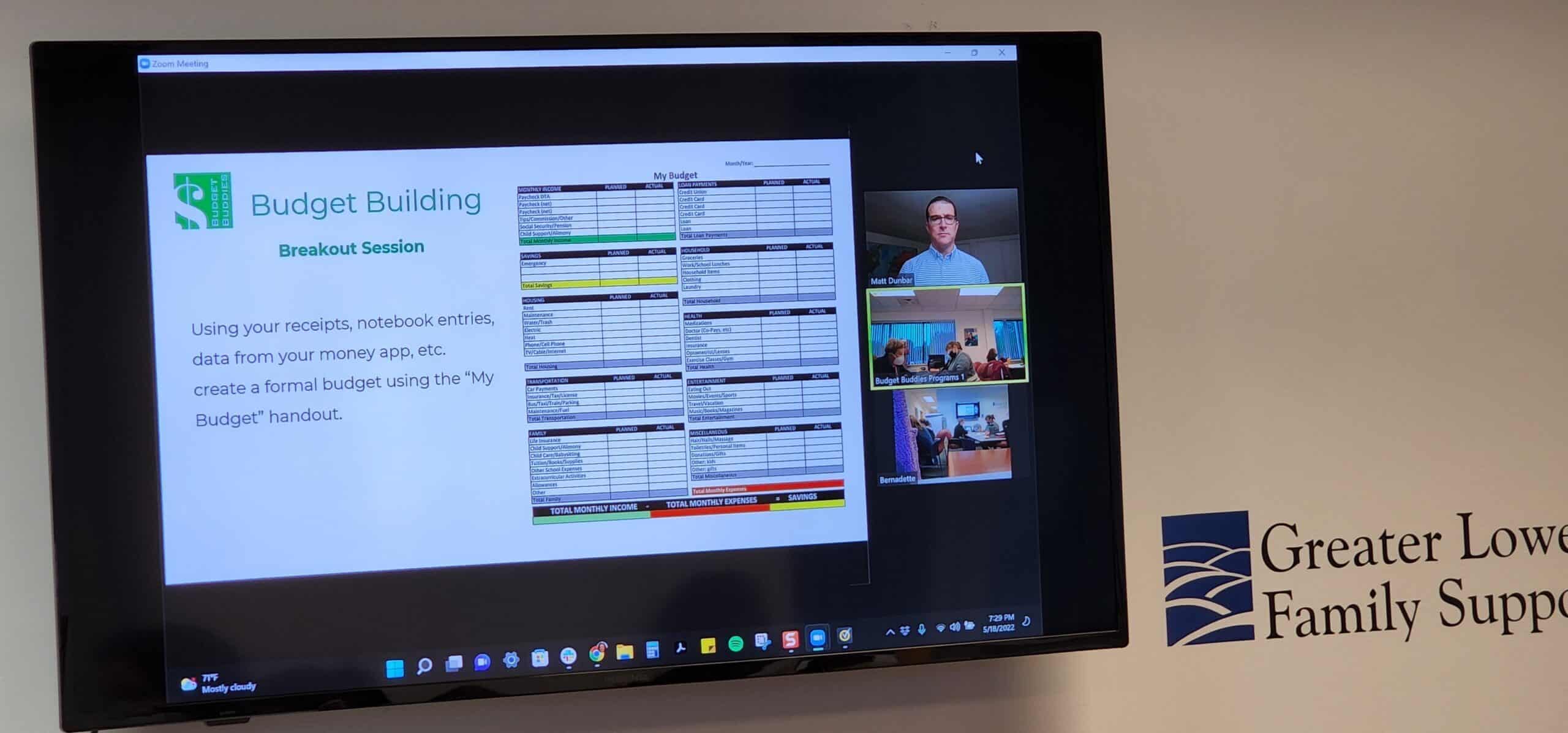

Presenter

Presenters facilitate specific workshops as part of the program’s curriculum. For each workshop, we have already developed the lesson plan and materials, presenters are there to lead the lesson and conversation. You select the workshop topic that you feel most passionate about! Presenters can facilitate as many or as few workshops as they would like and are available, so this is a great way for individuals to volunteer who cannot commit to being a coach.

Upcoming Programs

Step Two: Sign up for an upcoming workshop series.

In-Person Programs

Life Launch in collaboration with Greenhalge Elementary

- Starts: February 5th, 2026

- Thursdays 3- 4 PM EST

- In Person, English

- Full Schedule

- Our Life Launch program in partnership with Lowell Public Schools at Greenhalge elementary supports young girls in learning financial terms, confidence surrounding money, fun interactive activities about money, and building connection with teen/young women mentors!

Financial Futures Collective In-Person Lowell

- Starts: March 18th, 2026

- Wednesdays 6- 7:30 PM EST

- In Person, English

- Full Schedule

Rockridge Financial Futures

- Starts: May 5th, 2026

- Tuesdays 3- 4:30 PM EST

- In Person Northampton, MA, English

- Full Schedule

Somerville Housing Authority Financial Futures

- Starts: May 6th, 2026

- Wednesdays 5:30- 7:30 PM EST

- In Person, English

- Full Schedule

Virtual Programs

Financial Futures Collective *Daytime*

-

- Starts: March 4th, 2026

- Wednesdays 12:00-1:30 pm EST

- Virtual, English

- Full Schedule

Financial Futures Collective with DTA Works

-

- Starts: March 5th, 2026

- Thursdays 11 – 12:30 pm EST

- Virtual, English

- Full Schedule

Financial Futures Collective

-

- Starts: March 11th, 2026

- Wednesdays 6:30-8 pm EST

- Virtual, English

- Full Schedule

Financial Futures Collective

-

- Starts: March 17th, 2026

- Tuesdays 6:30-8 pm EST

- Virtual, English

- Full Schedule

Financial Futures Collective

-

- Starts: March 21st, 2026

- Saturdays 9:30-11 am EST

- Virtual, English

- Full Schedule

Financial Futures Collective

-

- Starts: March 23rd, 2026

- Mondays 6:30-8 pm EST

- Virtual, English

- Full Schedule

Life Launch Collective (ages 14-22)

-

- Starts: April 2nd, 2026

- Thursdays 6-7 pm EST

- Virtual, English

- Full Schedule

Road to Retirement

-

- Starts: April 2nd, 2026

- Thursdays 6-7:30 pm EST

- Virtual, English

- Full Schedule

Spanish Programs

Financial Futures Collective Spanish

- Starts: 19 de marzo 2026

- jueves 6:30- 8 PM EST

- Virtual, Spanish

- Full Schedule

We regularly add new workshop dates and are always in need of volunteers—the heart of our program. Stay informed about upcoming opportunities by subscribing to our newsletter.

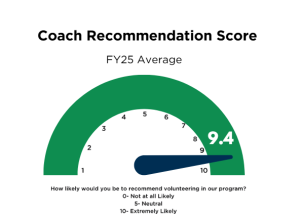

Hear from Volunteers

Learn how Women’s Money Matters volunteer hours can help you achieve certifications and advance your professional development.

Volunteer Frequently Asked Questions

How to Get Involved

What is the time commitment each week for each role?

Volunteer Coach:

~2.5 hours per week for the duration of the program (~3-4 months). Each week will include 1 hour of 1:1 time (or more if you choose), and a 1.5 hour WMM workshop. If you need to miss a workshop or two, that is ok just communicate with us and your partner!

Volunteer Presenter:

~3-4 hours per workshop: 1.5-2.5 hours to prepare for the workshop and 2 hours on presentation day. Once you have presented a workshop, the preparation time will be less if you present again in the future!

I am not available during normal working hours. Would this prevent me from being able to volunteer as a coach?

Not at all! The majority of our programs take place in the evening, though some are offered during the day. The coach and participant paired together decide the best time to meet between workshops that will work for both of their schedules.

What if I need to miss one or more workshop sessions?

We understand that an unavoidable conflict may come up, people get sick, etc. The success of the program relies on a commitment from both the coach and their partner to attend as many workshops and one-on-one sessions as possible. If it is something you know about in advance, be sure to let the Program Leader know so they will ensure that your participant has support during the breakout session/workshop. Also let your partner know that you will not be there and encourage them to attend in your absence so they do not miss the week’s lesson. If you know in advance that you will be missing multiple workshops, our Volunteer Manager can help you find a program that will better fit your schedule.

Can I coach multiple participants at once?

Coaches can only coach one participant per Women’s Money Matters program. We pride ourselves in the meaningful one-on-one relationships that are built between coaches and participants, which have proven most successful in supporting participants in meeting their financial goals. Special circumstances where experienced coaches want to volunteer for multiple programs (e.g., if programs that may overlap shortly or meet at different times) will be considered on a case-by-case basis by program leadership.

Are volunteer positions (e.g., coaches, presenters) compensated or provided stipends?

Coaches and presenters are volunteers who give their time to women in our programs.

Volunteer Qualifications

What qualifies a person to be a coach?

The women in our financial health programs need a different type of financial coach. Our participants come from a diverse set of backgrounds and, unfortunately, many have experienced some form of trauma in their lives. For these reasons, while our participants come to us to get support in meeting their financial goals, they really need someone who can take the time to understand their full life picture in a non-judgmental and compassionate way. Someone who cares about the participant holistically. Someone who is in their corner and wants to empower them and build their confidence to succeed, both personally and financially.

Do any workshops require a financial background to be a presenter?

Although a financial background is not necessary to be a presenter, some workshop topics such as Building Credit, Repairing Credit, and Fighting Fraud require a level of expertise on the topic and knowledge of current trends in order to feel comfortable responding to questions during the presentation. These workshops are often led by volunteers directly from financial institutions.

Do I need to be a woman to volunteer?

Coaches are required to be women (cis and trans women) or a non-binary person who is comfortable in a space that centers around the experiences of women.

Anyone, regardless of gender, is welcome to be a presenter as long as they are comfortable working in a women-centered space.

What technology do I need to have to participate in virtual programs?

You can join from any device anywhere as long as you have the internet access to connect to Zoom, we just ask that you have your camera on when possible to build a rapport with the group. It is preferred that the Tech Support role connect with a computer that supports full zoom functionality.

Why do I have to fill out a CORI (i.e., background check) and sign a confidentiality agreement?

Throughout the program, participants may be disclosing personal financial information with their partner via screen sharing or in person (example: credit reports, bank statements, online accounts). In addition to the our Life Launch program which may include participants under the age of 18, many of our participants are parents/caregivers of children, and it is entirely possible to encounter them throughout the program, especially during virtual programming and in-person one-on-one in meetings. We want to maintain trust with our participants and collaborating organizations by ensuring our volunteers are fully vetted.

Volunteer Training

What materials and resources will I receive and how will they be delivered?

At this time, materials (google slides for weekly workshops, zoom links, activities, etc.) are shared via google drive. This is expected to change with upcoming developments on our new website; regardless, materials will still be accessed electronically.

Is training required to be a volunteer?

All volunteers (coaches, presenters) receive official training and orientations, as well as all needed materials and resources to adequately fulfill their role. A Coach Exchange (zoom event) is offered each month for new and experienced coaches to come together and share ideas, experiences, and support each other through any challenges they may be facing.

Do presenters develop the workshops?

No, we already have a curriculum that was developed over many years in a really interactive way with many partners, participants and presenters providing input. Presenters are provided with materials and a lesson plan but are encouraged to augment the presentation with their own knowledge and flair while being sensitive to the audience to which they will be presenting.

Program-Related Questions

How am I assigned to a program? Can I choose which program I volunteer for?

As new programs are announced, volunteers will be notified (via email/newsletter) and will have the opportunity to review options and select which program they would prefer to enroll in based upon their personal schedule and availability.

How do you match your participants to coaches?

Participants and coaches are matched by the Volunteer Manager and Program Leader based on answers provided on the intake application/survey submitted by both participants and coaches, as well as information shared during the Introduction workshops. We encourage Coaches to let us know of any skills, abilities, or experiences that they feel would be helpful in the matching process.

What determines if a program will run longer? Would I know before signing up?

Program schedules are set before we start the process of recruiting coaches. Although very rare, if an adjustment needs to be made to an existing schedule after the start of the program, all participants will be notified in advance.

Our Volunteers

Many of our financial wellness programs are virtual so you can sign up to help create more secure financial futures for the women in our programs from anywhere. Our programs take place in the eastern time zone but our volunteers currently span the entire country, and even across the globe!

When SNAP benefits were delayed in early November, more than 100 women and girls living on low incomes reached out in crisis. They were struggling with impossible choices: between feeding their children or heating their homes, between paying rent or buying groceries.

ㅤ

You responded with extraordinary speed.

ㅤ

In less than a week, this community raised $20,000. Combined with a very generous donation of $10,000 from the @UnitedWay United Response Fund (URF) and our commitment through the Kathy Brough EmpowHERment Fund, we mobilized $20,000 to support 90+ women and girls living on the financial margins practically overnight. The support included connecting them with necessary resources from our incredible partners, @NeighborShare, @BostonBullPenProject, and @Axuda.microloan. We are deeply honored to have been selected for the United Way’s URF prestigious emergency funding, standing alongside vital community organizations like food banks as a trusted partner in crisis response.

ㅤ

Your gift wasn`t just money. It was dignity, relief, and proof that this community shows up when it matters most. The crisis doesn`t end because SNAP returned. These women and girls are still one unexpected expense away from impossible choices. Meeting immediate needs is critical, but what truly changes lives is helping women build the financial wellness skills and confidence to manage money even when systems fail them.

ㅤ

That`s what we`ve been doing for 15 years. Our Annual Appeal launches after Thanksgiving with an exciting match opportunity—stay tuned for details. For now: THANK YOU. 💙

ㅤ

#WomenMoneyMatters #FinancialWellness

When you invest in women who are living close to the economic margins during their most vulnerable moments, you`re preserving hope and giving them the chance to keep moving forward.

ㅤ

Our program participants and graduates have done everything right. They`ve created budgets, tackled debt, and built savings, often for the first time. But the reality is, many of our graduates and participants live incredibly close to the edge. There`s no cushion. No room for delays or disruptions. The current delays in SNAP benefits are threatening to undo the progress.

ㅤ

"My electricity is about to get shut off."

"We need groceries. $400."

"I can`t provide food for my household in November."

ㅤ

The Kathy Brough EmpowHERment Fund—named for one of our beloved co-founding mothers—is a dedicated fund specifically for direct relief requests like these. We are raising funds to protect the progress our graduates have made, and every dollar goes directly to women facing emergency needs right now.

ㅤ

The numbers reveal just how vulnerable our community is: More than HALF of all direct relief requests we`ve received this year came in October alone—$61,287 in just one month.

ㅤ

Your gift—whether it`s $25, $100, or $500—goes directly to women in the WMM community and will help keep them from losing what they`ve worked so hard to build.

ㅤ

Donate to the Kathy Brough EmpowHERment Fund using the link in comments or visit our website.

Women`s Money Matters is more than just financial education—it`s a supportive community where you`ll gain the tools AND the personal attention you deserve. Join us to transform your relationship with money alongside other women in a supportive environment!

ㅤ

Upcoming Start Dates for 8-week Programs

📅 Financial Futures (for adults) Program Start Dates

Nov 15th | Saturdays | 9:30 AM

Nov 18th | Tuesdays | 6:30 PM

Nov 24th | Mondays | 12 PM

ㅤ

📅 Life Launch (ages 14-22) 11-Week Program

Nov 18th | Tuesdays | 6 PM

ㅤ

📅Level Up Workshop – for Graduates and Current Participants

Nov 6th | Debt & Bankruptcy 101 | Thursday | 6:30pm

ㅤ

See links below to join us!

October is Domestic Violence Awareness Month, and part of this awareness is understanding the toll of financial abuse. Nearly all domestic violence survivors experience financial abuse—control tactics that trap survivors and make it difficult to leave or rebuild their lives. This can include restricting access to funds, opening accounts in a survivor`s name and destroying their credit, controlling all spending and finances, using money as leverage, or interfering with someone`s ability to earn income.

ㅤ

We are honored to partner with amazing organizations that offer critical advocacy, counseling, and resources to survivors, such as Jane Doe, The Second Step, Rosie’s Place, and our new partner organization, The Resilience Center of Franklin County. The first cohort begins at The Resilience Center next month, and we recently completed a Level-Up on Financial Abuse with Second Step.

ㅤ

You are not alone. If you`re experiencing domestic violence, there is confidential support available whenever you`re ready. The National Domestic Violence Hotline is open 24/7: call 1-800-799-7233 or text "START" to 88788. Massachusetts SafeLink: 1-877-785-2020.

ㅤ

See websites for our partner organizations below:

Advocacy in action! There’s been a significant step forward in ensuring all Massachusetts students receive financial education before graduating high school: The Massachusetts House Education Committee has voted 11-0 to approve House Bill 627, an Act that strengthens the standards of financial literacy for K-12 throughout the commonwealth.

ㅤ

Key parts of the bill: ✅Minimum of 1/2 semester course in personal finance required to graduate from HS ✅Establishes the Financial Literacy Trust Fund ✅ Requires experiential learning ✅Creates a commission to study financial resources for adults.

ㅤ

This unanimous vote demonstrates strong bipartisan support for financial literacy education. The bill now moves to the House Committee on Ways and Means for further review.

ㅤ

While this is tremendous progress, our advocacy work continues. We`ll keep pushing for: Expanded standards for grades K-8 District accountability and reporting requirements to DESE

ㅤ

Your voices made this happen. Thank you to everyone who testified, wrote letters, and stood up for financial education equity in Massachusetts.

ㅤ

Bill details: Bill H.627

What do you think? Let your legislators know! Share your story! Keep the momentum going - continue writing to your legislators – link in comments.

ㅤ

#FinancialEducation #Massachusetts #Advocacy #WomensMoneyMatters #FinancialLiteracy #EquityInEducation

It`s been an inspiring month connecting with partners and community leaders driving change! We are deeply grateful to be part of such a strong network of organizations and leaders who share our unified mission of creating equitable opportunities and brighter futures for women and girls throughout Massachusetts.

ㅤ

We recently joined the @womensfundec 2025 Grantee Celebration Breakfast. Attended by Jenna Olson, WMM Senior Development Manager, we were honored to be a part of a collective of organizations that continue to build opportunity, stability, and hope for women and girls across our communities.

ㅤ

WMM Executive Director, Danielle Piskadlo, attended the @womensfoundationma`s Make Her Mark fundraising event - a night celebrating girls, education, & possibility. Every dollar raised at the event supports women and girl-serving nonprofits in some of the most under-resourced communities across Massachusetts.

ㅤ

Later in the month, we joined the @easternbank Foundation`s Celebration of Social Justice, honoring Nancy Huntington Stager for her leadership and lasting contributions to advancing social justice. Pictured: Bernadette Wheeler, WMM`s Chief Program Officer, alongside Laurie Calvert, Director of Finance at Somerville Community Corporation — a longtime WMM volunteer and former program lead.

ㅤ

And finally, Women`s Money Matters was honored to be named the 2025 McNeil Community Impact Award Honoree by @lcprobono, recognized for our work empowering women and girls living on low incomes to strengthen their financial health and create more secure futures for their families and communities. Pictured is Board member Imran Malek with WMM Executive Director Danielle Piskadlo, who received the award on behalf of the WMM team.

ㅤ

If you or someone you know relies on SNAP (food stamps), please read this carefully and share widely.

ㅤ

What`s Happening?

Due to the ongoing government shutdown, approximately 42 million Americans may not receive their SNAP benefits in November. Multiple states have already issued warnings that benefits may be delayed or not issued at all starting November 1st.

ㅤ

What to do:

Use remaining October benefits to stock up on shelf-stable foods (canned goods, rice, pasta, dried beans, peanut butter)

ㅤ

Check your EBT card balance - some states warn that October balances may not carry over

ㅤ

Update your contact information with your state SNAP office to receive alerts

ㅤ

Submit any pending applications or renewals immediately - even if processing is delayed, your case will move forward once the shutdown ends

ㅤ

Need food now? Find Local Options near you:

🟢Feeding America Food Bank Locator: feedingamerica.org/find-your-local-foodbank

🟢Massachusetts residents: Call Project Bread`s FoodSource Hotline at 1-800-645-8333

🟢Find local food pantries: Visit mass.gov/how-to/find-a-local-food-bank

ㅤ

Important to Know:

✅ Benefits will be reimbursed once the government reopens - this is a delay, not a permanent cut

✅ Keep applying/renewing - your application will be processed when operations resume

✅ Food banks are preparing for increased demand but cannot fully replace SNAP (for every 1 meal food banks provide, SNAP provides 9)

ㅤ

We`re in this together. Check on your neighbors, friends, and family members who receive SNAP and please share this information with anyone who might need it.

We’re inviting our WMM community to our next Level Up workshop: Debt & Bankruptcy 101. This one-time session is designed for individuals and families living on limited income who want to better understand how to manage debt and whether bankruptcy might be the right step.

ㅤ

Exclusively for WMM grads, current participants, and volunteers

📅 November 6th | 6:30-8 PM EST | Virtual In English

ㅤ

If you’re living paycheck to paycheck or feeling overwhelmed by debt, this session will give you practical guidance and confidence to take control of your finances.

ㅤ

Ready to level up? Register at the link in the comments, or Text: 617-297-7376 or Email: [email protected]

What an incredible morning! Our Elevate Her Future celebration filled the Boston Marriott Newton with support, community, and commitment. Thank you to Angel Burgado, VP, Community Partnership Manager at @santanderbankus , for being our amazing MC and reminding us that "giving hope is free"—a message that resonated throughout the morning.

ㅤ

Sarah Samuels, CFA, CAIA, (@Samuesn1) Partner and Head of Investment Manager Research at NEPC, inspired us with her journey from administrative assistant to partner overseeing $1.8 trillion in assets. As founder of @30secondsofbravery and author of Braving Our Savings, she challenged us to take brave steps toward financial empowerment and encouraged young girls to transform money into capital by investing early.

ㅤ

We were honored to present the WMM Elevate Her Future Award to Patti Satterthwaite, President of the @womensfoundationma. More than a funder, WFM has been a partner and visionary force, helping us dream bigger and drive systemic change for women and girls across Massachusetts.

ㅤ

The heart of our celebration was hearing personal stories of transformation from women in our programs: Raysa Ortega Cruz, Assistant Manager at Rockland Trust and WMM Volunteer; Dawnmarie Simpson, WMM Program Lead and Coach; and Lumina Mathurin, WMM Graduate turned Coach. Their stories showed how relationships, paired with practical skills, create lasting financial empowerment.

ㅤ

Corporate Sponsors: @rockland_trust 💫 @grasshopperbank 💫 @experienceberrydunn 💫 @statestreetim_us 💫 Acadian 💫 @womensbusinessleague

Individual Sponsors: 💫 @JessicaAikenScola, Sound View Financial Advisors 💫 Carolyn M. Wood, WMM Board Member 💫 Family of Karol Ostberg

ㅤ

To every volunteer, funder, partner, sponsor, and participant who showed up or supported our event from afar —thank you for believing in this work. Together, we`re proving that financial empowerment, plus community, creates true transformation. Here`s to the next 15 years!

ㅤ

We were thrilled to attend the 4th Annual Financial Equity Summit 2025 hosted by the Partnership for Financial Equity!

ㅤ

Our Chief Programs Officer, Bernadette Wheeler, joined colleagues and community leaders for this impactful event at The Vault in Lawrence—a beautifully converted historic bank that set the perfect tone for conversations about the future of community banking.

ㅤ

The day featured compelling discussions, including a panel on "What Does Trust in Banking Really Mean?" led by Jason Andrade. This session explored fascinating new research on what trust means in today`s financial landscape and how institutions can strengthen relationships with the communities they serve. We also engaged in thoughtful conversations with local banks about the future of in-person banking and how financial institutions can better meet community needs.

ㅤ

It was wonderful to reconnect with Brianne DiBiase from Rockland Trust and Aida Franquiz from Leader Bank, both of whom serve as coaches and presenters in our programs. The summit closed with a keynote from Anna Gifty Opoku-Agyeman, author of "The Double Tax: How Women of Color are Overcharged and Underpaid," a critical topic of importance in financial equity.

ㅤ

It was great to strengthen our network of our friends at ACT Lawrence, led by CEO Erika Hernandez, and Lawrence CommunityWorks, led by CEO Jess Andors. Both organizations are doing remarkable work in the community, supported by local financial institutions, to meet the needs of their clients and create meaningful, lasting impact.

ㅤ

Thank you to the Partnership for Financial Equity for bringing us together such an important conversation!

ㅤ

#FinancialEquity #CommunityBanking #Lawrence #BankingWithPurpose

Elevate Her Future is Coming Up This Friday!

ㅤ

Join us this Friday, October 17th from 8:30 AM – 10:30 AM at the Boston Marriott Newton (2345 Commonwealth Ave, Newton) as we celebrate 15 years of empowering women and girls with financial skills and resources.

ㅤ

Start your morning with breakfast and inspiration, connect with others committed to making a difference, and help shape the future of financial empowerment.

ㅤ

Tickets: $75 – Available online and at the door. Learn more and purchase tickets at our website.

ㅤ

Thank you to our wonderful sponsors: @rockland_trust, Acadian, @grasshopperbank, @experienceberrydunn, @womensbusinessleague, and @statestreetim_us. Additional thanks to WMM Board Member Carolyn M. Wood, The Family of

Karol Ostberg, WMM AG Member Jessica Scola, and all of our anonymous donors.

ㅤ

We`ll see you all on Friday!

We are thrilled to share that Women’s Money Matters has received an $82,500 grant from the @MassMutual Foundation to bring our financial wellness programs to Springfield, MA—one of the areas of greatest need in the state. With this support, we will extend our proven model of financial literacy workshops, personalized coaching, and community-based support to more women striving to build brighter, more secure futures for themselves and their families.

ㅤ

As part of this expansion, we are also investing $7,500 to join @unioncapitalnetwork, a powerful community network - and fellow MassMutual Foundation grantee - that strengthens local connections by engaging families in programs, sharing resources, and supporting collective action.

ㅤ

Why Springfield? The need is urgent: Springfield’s poverty rate (25.26%) is more than double the Massachusetts average (11.5%), and nearly 1 in 3 women in Springfield (29.1%) lives in poverty, compared to just 9.9% in Quincy.

ㅤ

This grant builds on a deep and growing partnership with the MassMutual Foundation. We are deeply grateful to the MassMutual Foundation for their generous investment and continued commitment to advancing financial security for women and families across Massachusetts. Together, we are building stronger, more resilient communities.

#WomensMoneyMatters #MassMutual #UnionCapital