This past week President Biden signed a bipartisan debt ceiling agreement that “codified” an end to the payment pause for student loan borrowers. In response to this seismic event, there has been a steady stream of articles about the adverse impact of the resumption of payments: according to a recent survey by Student Debt Crisis, 89% of fully-employed borrowers aren’t “financially secure” enough to restart payments and this event will have a “severe” impact on the economy.

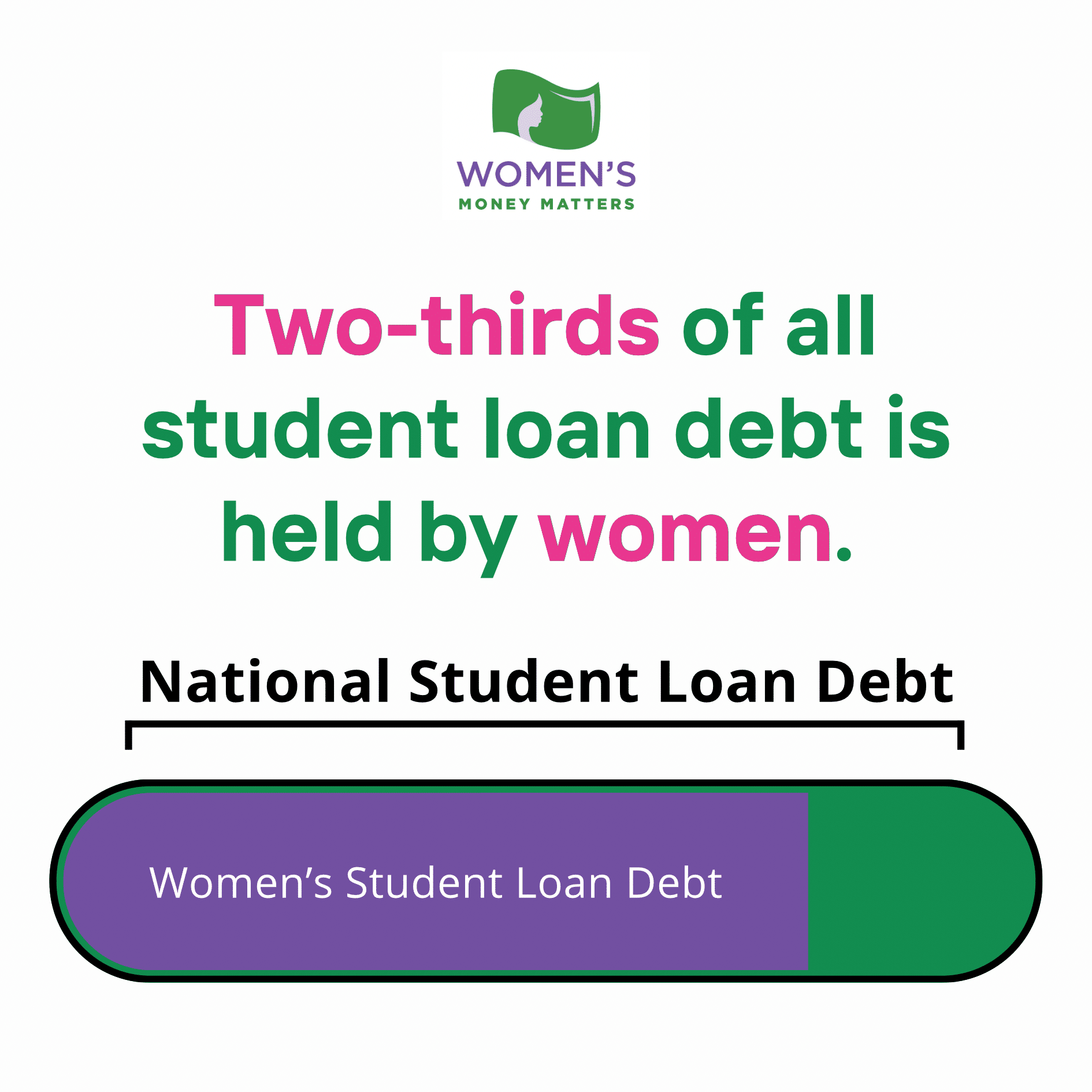

What has been overlooked is that the lives of WOMEN will be disproportionately impacted by this event because WOMEN account for almost 2/3rds of student loan debt!!

Harvard Ed School graphic

Harvard Ed School graphic

“I can promise you that women working together – linked, informed and educated – can bring peace and prosperity to this forsaken planet.” Isabelle Allende

If you are nervous and understandably confused about the resumption of student loan payments, you are not alone. If you are worried about managing this new monthly payment, you are not alone. The good news is that by working together and taking advantage ofthe resources available to borrowers in the WMM community, you can find a workable solution. The key is to become fully informed about your loans and understand the menu of manageable repayment options.

What Women Borrowers Can Do Now:

- Log into your account at the federal student aid website: https://studentaid.gov/

- Verify that your contact information is accurate, including mailing & email address

- Review your loan balances, print out a copy for your records and verify your loan servicer; every borrower is assigned a company (loan servicer)

- If you are unemployed, do not ignore your payment; if you are enrolled in an Income Driven Repayment Plan (IDR), you might be eligible for 0$ per month payment

- Make sure you are enrolled in a more affordable income-driven repayment plan and use auto-pay; it automatically provides you with a .25% savings on the loan interest rate

- Begin to budget for the resumption of federal student loan payments in September

There is no need to panic. “Working together,” WMM can help you to create a manageable and affordable repayment plan.

Robert J. Miller, Advisor for Women’s Money Matters