In a recent Census Bureau survey, 40% of Americans indicated that they are struggling to afford household expenses, saying that they are finding it “somewhat difficult” or “very difficult” to cover these costs.

With inflation rates increasing year over year according to the U.S. Department of Labor costs are higher than we have seen in years on everything from household goods to cars to gas.

In the Boston area, food prices have jumped 7.1% since March of 2021, with electric and gas services increasing by 14.5 and 27.0% respectively. Gasoline prices are up 53.6%!

Women’s Money Matters, formerly Budget Buddies, knows and has seen first hand that these economic downturns have a greater impact on women living on low incomes (or economic margins) as they are consistently hit hardest by inflation, increasing gas prices, and recessions.

This comes on top of the COVID-induced “she-session” that caused many women to lose income as female workforce participation dropped to 57%, the lowest since 1988. Since the pandemic started, over 5.4 million women have left or lost jobs.

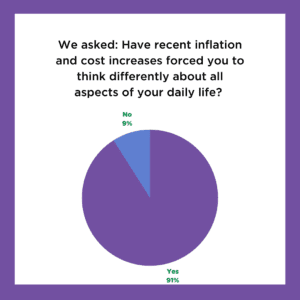

We spoke with some of the women who have participated in our Women’s Money Matters Collective, comprehensive financial health programs for women living on low-incomes, about how they have been impacted by recent rising costs.

Ninety one percent of the women we surveyed indicated they are being forced to think differently about all aspects of their daily lives, including limiting driving to conserve gas, avoiding brand names (especially on groceries) and delaying large purchases.

As budget constraints become even tighter, some women have begun putting off necessary expenses, like medical procedures. Marjorie, a recent graduate shared that she “needs a $1,300 crown on my tooth,” that she can’t afford right now.

Many women have begun comparing prices at different grocery stores, couponing and are making cuts to more expensive grocery items such as meats and healthy foods.

From the women we spoke with, 56% said they are adjusting how much they drive to conserve gas.

“I think about how much driving is going to cost me. I get my haircut 26 miles from my house, which adds $10 to the price of my cut,” said one participant.

Carol M. shared that in order to save money on gas, she now does her “grocery shopping online 90% of the time and whenever I make a doctor’s appointment, I ask if possible to do Telehealth.”

For younger individuals, some are being forced to live at home longer as housing prices increase by 6.3 percent. One of our participants shared that she has had to delay moving out of her parents’ house and becoming completely independent due to the increasing housing cost.

We also continue to see rising impacts on mothers and single mothers. In Massachusetts alone, 33% of single mother households live in poverty. We have heard from participants that the rising cost of childcare and inflation is causing women to reflect and change their budgets.

One of our participants shared, “It generally affects single mothers with minimum wages and few working hours, food is twice as expensive and it limits parents to cover other household expenses.”

Women’s Money Matters is here to help women living on the economic margins navigate this challenging financial time of high inflation and future economic uncertainty. We encourage women who are struggling to reach out to us and learn more about joining a Women’s Money Matters Collective program directly for access to 1:1 coaching, peer support and a series of comprehensive and tailored financial health workshops.

Our welcoming community of volunteers and participants understand the challenges many women are facing in these difficult times and are ready to assist those who need our help.

Media Inquiries please contact Laura Giordano [email protected]