April 30th, 2025: We are thrilled to announce the official press release about Bridge To Prosperity: Benefits Cliff Pilot. See the full text below and keep an eye out for additional coverage by local media outlets. We are grateful for the support from JPMorganChase and Springfield WORKS, and we look forward to sharing the stories of direct impact as the cohort of local participants grows. For more information, see our full webpage about this pilot, including additional resources.

Women’s Money Matters Advancing Pilot Program to Empower Massachusetts Families and Build their Financial Equity and Success: Multi-year pilot program receiving support from JPMorganChase to address cliff effect challenges facing many low-income families

Women’s Money Matters is today advancing a multi-year pilot program in collaboration with Springfield WORKS to address the pervasive cliff effect that traps many families in cycles of poverty and prevents them from building generational wealth.

With a $500,000 philanthropic grant from JPMorganChase, the Bridge to Prosperity Cliff Effect Pilot will empower families receiving public assistance benefits to overcome financial challenges and achieve sustainable independence. This program will test the impact of supplemental financial support, combined with financial and career coaching to help families navigate the transition from public benefits assistance to sustained economic mobility and prosperity.

The Bridge to Prosperity Cliff Effect Pilot is a state-wide project that seeks to work with up to 100 low-income working families who are receiving public assistance and live in greater Boston, Worcester and Springfield. In addition to supporting participants and their families on the road to economic financial stability, the pilot also aims to demonstrate how public and private investments can help households successfully transition from public assistance to permanent employment that meets their financial needs across the US.

The “Cliff Effect” refers to a barriers in our public benefits system that inadvertently disincentivizes work. Eligibility for family supports like food, health care, housing and childcare assistance are based on income. The Cliff Effect happens when families’ income increases enough that they lose eligibility for these benefits, but not enough to yet afford housing, health care, and childcare on their own. The result is that an increase in wages often leads to a decline in standard of living – working harder, but bringing less income home.

Research from the pilot will be used to:

● Demonstrate the impact of transitional support to help families bridge the economic mobility gap created by the benefits cliff while pursuing employment pathways to a living wage

● Reinforce workforce development efforts and combating worker shortages

● Demonstrate the case and providing data for systemic policy change to create pathways for greater financial security and generational wealth building.

Danielle Piskadlo, Executive Director of Women’s Money Matters, says, “We are deeply grateful to JPMorganChase for their incredible support. This grant will significantly bolster our efforts to support working families and ensure that the system is working to improve their economic wellbeing and remove barriers that prevent them from accessing opportunities to improve financial well-being.”

Anne Kandilis, Director of Springfield WORKS, Western Mass Economic Development Council, commented “Springfield WORKS is thrilled to partner with Women’s Money Matters to advance this critical Pilot. Health care, hospitality, education, front line, and part-time workers are disproportionately affected, as are women and people of color who work in these jobs. Our ability to meet current labor needs and grow our economy depends on creating the right economic incentives and making sure the pathways to career opportunities are open and accessible to all.”

“A good job, with the promise of growth and upward mobility, is important to helping people build a strong financial foundation and improve their financial health. However, for too many families, the risk of losing essential benefits that help manage daily needs discourages them from taking opportunities to invest in their future,” said Mercedeh Mortazavi, Head of Financial Health, JPMorganChase Global Philanthropy. “We’re thrilled to support Women’s Money Matters in this work to help more Massachusetts families improve their financial health, while building an evidence base for a model that can empower more Americans to pursue greater economic opportunity.”

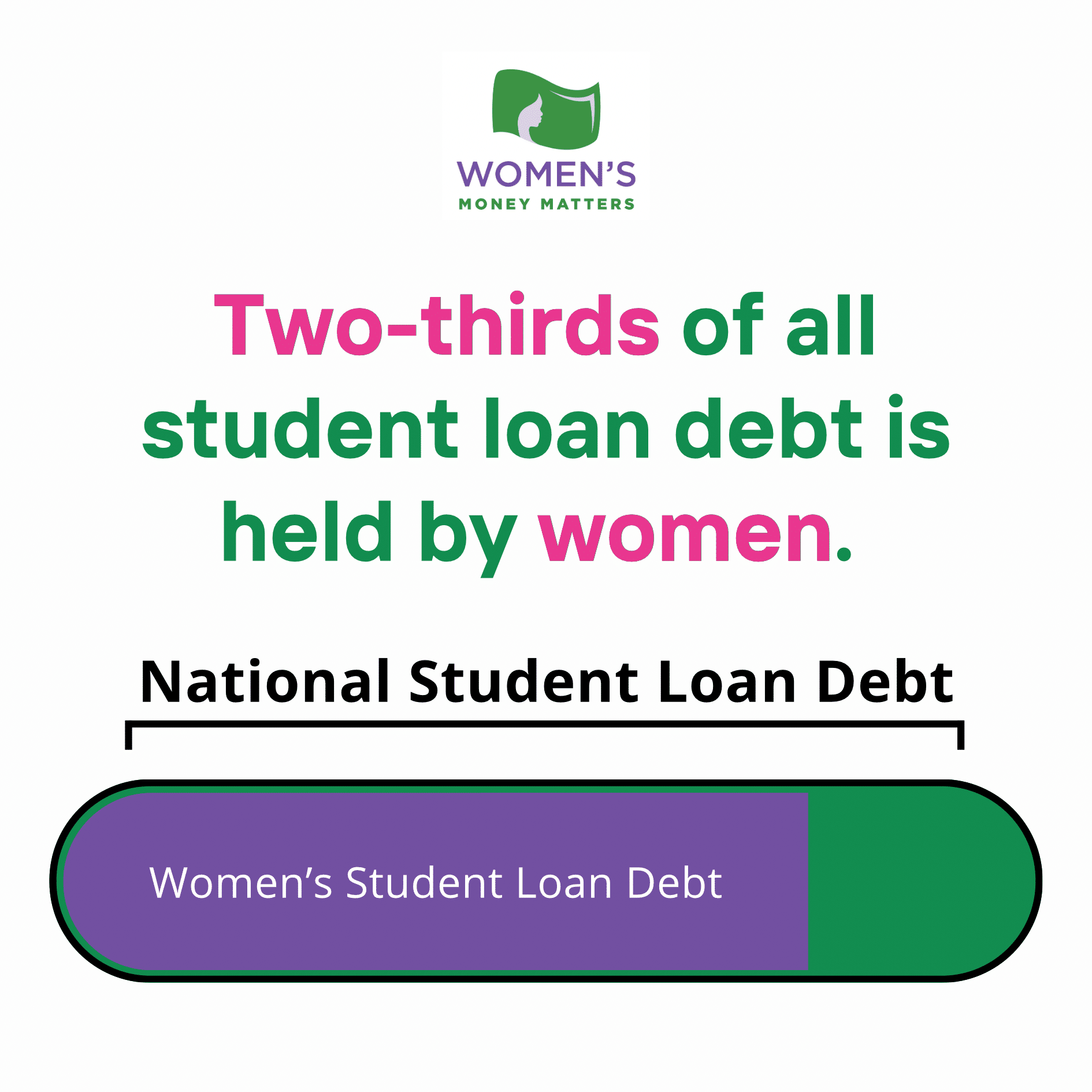

Public benefits are a necessary lifeline for families living on lower incomes. This is especially true for those living at or below the federal 200% poverty level, which is defined as an annual income of at least $46,800 for a family of four. However, according to the Federal Reserve Bank of Cleveland, “the benefits cliff can affect people with incomes up to about $60,000 a year” meaning it affects individuals beyond what is considered poverty. Any attempt at improving their financial circumstances could mean forfeiting the support they need to meet their basic living requirements, forcing families to make a choice between daily survival or building wealth.

Nationally, 38 million people live at or below the federal 200% poverty line, meaning that the benefits cliffs prevent over 12% of the U.S. population from taking steps to pursue economic mobility. In Massachusetts, over 700,000 individuals live at or below the poverty line and face benefits cliff issues.

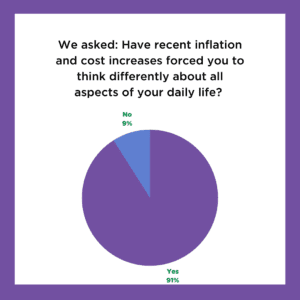

Women’s Money Matters witnesses the consequences of the Cliff Effects every day. Through our financial wellness programs, women feel empowered to continue their journey and increase their income for themselves and their families, until they are face-to-face with the benefits cliff.

Change takes time and this multi-year pilot project will demonstrate how employment, coaching, and financial support will impact participants’ economic and family well-being. If successful, this pilot will serve as a model for change and demonstrate innovative ways of rethinking America’s safety net programs to more effectively support entry into meaningful work and career advancement to economic mobility.

For more information

About Women’s Money Matters:

Women’s Money Matters, a nonprofit organization whose mission is to empower women and girls living on low incomes with the tools to transform their financial futures. WMM programs provide essential money management skills and a strong support network, enabling participants to create secure, stable lives for their families and communities. WMM serves women and girls aged 8 through retirement who are living on low incomes, many in transitional housing. Core programs provide one-to-one coaching, and peer cohorts for social support and belonging. Topics include building and repairing credit, creating a spending and savings plan that works, and keeping your money safe. Volunteers are core to our work. There are a range of remote and in person opportunities. All you need is the desire to help another women or girl make the most of the money she has. WMM has reached thousands of women across Massachusetts and continues to grow programming to meet the demand for programming. For more information contact Women’s Money Matters at (617) 297-7376; Danielle Piskadlo [email protected]

About Springfield WORKS: https://springfieldworks.net/

Springfield WORKS, an economic development initiative with the Western Mass Economic Development

Council, is dedicated to removing systemic and racial barriers to economic mobility and well-being.

Through targeted collaboration with community partners, employers, policymakers, educators, and

residents, our work is influencing the way employers source talent and career seekers gain access to

economic opportunities by providing solutions, networks, tools, and resources that remove barriers to

prosperity. For more information contact Anne Kandilis at [email protected].

About JPMorganChase

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorganChase had $4.4 trillion in assets and $351 billion in stockholders’ equity as of March 31, 2025. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers predominantly in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com

—————————————————————-